There’s no denying that the equity markets have taken on a decisively different look and feel in recent weeks. We’ve compared the charts of the S&P 500 and Nasdaq 100, as well as leading growth stocks like Nvidia, to an airplane experiencing a “power-on stall”. Basically, the primary uptrend has been paused, but it’s unclear whether we’ll resume the uptrend after a brief corrective period.

I stand by my previous comments that the 200-day moving average, as well as the price gap formed in early May, remains the most important “line in the sand” for this market. And as long as the S&P 500 and other leading names remain above their 200-day moving averages, then equities are still in decent shape.

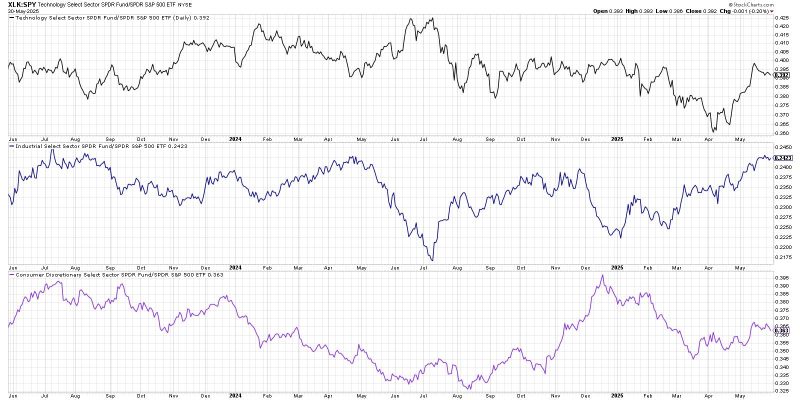

One of the key features of this market off the early April has been the dominance of traditionally “offensive” sectors such as technology and consumer discretionary. But are these leading sectors maintaining their leadership role as we progress through the spring months into the summer?

Leading Sectors Off the April Low Starting to Falter

My Market Misbehavior LIVE ChartList includes a series of relative strength charts showing the performance of key sectors versus the S&P 500. When these lines are trending higher, the sector is outperforming the benchmark. Generally speaking, I’d prefer to own stocks where the relative strength line is trending higher, as that confirms I’m doing better than a passive investment strategy!

Only three sectors have outperformed the S&P 500 index over the last month: technology, industrials, and consumer discretionary. Notice how two of those sectors, technology and consumer discretionary, are seeing a downturn in relative strength over the last week? It still may be early to declare a full leadership rotation, but this initial downturn in the relative performance could be a sign of further weakness to come.

Defensive Sectors Showing Early Signs of Strength

So if these leadership sectors are starting to slow down, which sectors are showing an improving relative strength? Our next chart shows the relative performance of the four traditionally defensive sectors, most of which have turned higher over the last two weeks.

Again, I’d hesitate to declare this a full and confirmed rotation, but the fact that defensive sectors are improving here suggests investors are beginning to reallocate a bit to more risk-off positions. Over the next few weeks, improvement in these defensive sectors could provide a clear validation to a “market in correction” thesis.

Relative Rotation Graphs Confirm Defensive Rotation

Of course, when we’re talking about sector rotation, I always want to bring up the Relative Rotation Graphs (RRG) and benefit from Julius de Kempenaer’s innovative data visualization approach. First, let’s see how the daily RRG showed the 11 S&P 500 sectors back in early May.

We can see that the Leading quadrant includes those leading sectors such as technology. In the Lagging quadrant we’ll find pretty much everything else, including all four of the defensive sectors discussed above. Now let’s fast forward to the current RRG and see how things have rotated.

Now you’ll find health care, consumer staples, and other defensive sectors in the Improving quadrant. Technology, industrials, and consumer discretionary have now rotated down into the Weakening quadrant. So the RRG is showing at least an initial rotation away from the sectors that have been leading off the April market low.

One of the most important arguments from the bulls has been the dominance of offensive sectors over the last six weeks. But as we’ve shown here today, the sector may be changing from a clearly bullish reading to a much more defensive warning sign for investors.

RR#6,

Dave

PS- Don’t miss our daily market recap show on YouTube every trading day at 5:00pm ET!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Research LLC

https://www.youtube.com/c/MarketMisbehavior

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.